Reducing Risk in Your Portfolio

By Kristopher Meuwissen

As the title suggests, this article is all about removing or reducing risk in your portfolio and that means you need to understand what RISK is for YOU.

Allow me to elaborate by using an example.

The average person faces many different types of risk in a day. Some risks we all face such as the weather and general hazards like tripping over that box you have left next you’re your front door for a week (Yes, we all that a box at our front door). But some people take a lot more risk in their daily lives such as electricians with live wires and carpenters using saws and working at heights.

The reason why I am explaining this is because you will have often have different investment risks that are intolerable to you that you in particular need to avoid. For example, a retiree needs to avoid loss of capital as much as possible which makes a large use of cash and bond assets more useful whereas a 25 year old needs to protect themselves from the effects of rising living costs which makes cash investments far less desirable.

So what are the common types of risk that may affect your portfolio?

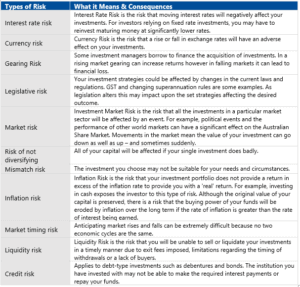

The table below summarises some of the risks that an investor may incur when investing money in different markets. Please note the list below is not extensive and that your exposure to risk is not limited to the list below.

Parts of the above table are extracts from “Understanding Investment” a joint publication from the FPA & Macquarie Investment Management Limited

Although risk is usually associated with the probability of losing all or part of your capital, in investment terms it is the likelihood of achieving or not achieving your expected returns or goals in a given time period.

So, whenever you make an investment decision it means that you are prepared to take a risk of some sort. This decision will relate to the amount of money you have to invest and your existing circumstances and your needs for the future.

You will never be able to remove all risk from investments but by understanding which risks are intolerable, you can start to pull the right levers to mitigate against catastrophe.

Have some questions? Want to know how it applies to you? Want a review of your personal situation? Click here to book a Free 15 Minute Discovery Session, give us a call on 1800 577 336, or email us at hello@wealtheon.com.au.

You can also check out our other articles to get you started on your financial journey here.

Information on this site may be regarded as general advice. That is, your personal objectives, needs or financial situations were not taken into account when preparing this information. Accordingly, you should consider the appropriateness of any general advice we have given you, having regard to your own objectives, financial situation and needs before acting on it. Where the information relates to a particular financial product, you should obtain and consider the relevant product disclosure statement before making any decision to purchase that financial product.