Make Your Money Last A Lifetime

For anyone who was ever paid fortnightly or monthly, the need to budget to ensure you had enough money to see you through until the next payday was essential. In many ways, a retirement income can be similar, albeit within a much longer timeframe.

Research shows that the biggest spending years are at the start of retirement.1 This is when the newfound freedom that comes with retirement can translate into more travel, home improvements and more time to do the things we have long anticipated.

That can also lead to anxiety about having enough money for the future and can stop us truly relaxing and enjoying this early stage of retirement.

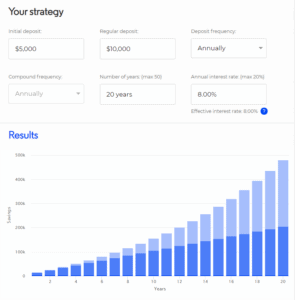

With the average time spent in retirement now exceeding 20 years, income worries can increase as you age. This is shown in the YourLifeChoices’ 2018 Retirement Income and Financial Literacy Survey, where almost half (48 per cent) of the 5,064 respondents were concerned their savings would not last in retirement.

Lifetime annuities can help to reduce these concerns. They provide a secure, guaranteed income for life and can form the foundation of your retirement plan. They act as a safety net ensuring you will receive income for life, regardless of how long you live or how investment markets perform.

A lifetime annuity should be seen as one of several income streams you can put in place to help make your overall finances go further to support your lifestyle and changing retirement circumstances.

When it comes to weighing up retirement income options, it can seem as if you’re being forced to choose between future income certainty on the one hand, and the potential for better investment returns on the other. By layering an annuity with other retirement income streams, you can achieve the best of both worlds, with enough income certainty to give you peace of mind and a degree of flexibility with your other investments.

The Trade-Off Myth

A comparison of lifetime annuities and account-based pensions is often completed with the aim of choosing one product over the other. As each product has different characteristics, it may be worth considering how these features can help meet your retirement income needs.

With account-based pensions, there’s the opportunity to invest your balance according to your risk return preferences. Based on your risk-return preference, some investment choices may be linked to market performance. These market-linked investments offer the possibility for growth. However, if markets become volatile, your retirement savings and income might not last the distance.

Lifetime annuities are protected from market volatility and offer an income that’s guaranteed, even if you live longer than expected.

Remember that choosing an annuity for increased security of income doesn’t mean throwing out the account-based pension option altogether. A comprehensive retirement portfolio should include a range of strategies to provide a secure income, as well as income invested for growth, in order to take care of the occasional extras and one-off expenses.

Taking Care Of Essentials

Lifetime annuities can play an important role in securing a layer of income to meet your essential needs.

Together with the Age Pension (if you are eligible), guaranteed income payments from a lifetime annuity can help ensure you have the income you need to cover the essentials, such as household bills, groceries and medical expenses.

Income from a lifetime annuity is protected from market volatility and, if you’ve chosen to link your payments to the yearly changes to inflation, it will allow you to continue to afford tomorrow what you can afford today. When you can be certain you have the cash flow to pay for those essential costs indefinitely, you take a lot of the stress out of living – and being retired.

Discretionary Spending

Once you’ve calculated the cost of meeting those essential needs and securing an income to match, you can explore ways to invest any remaining savings. By selecting a combination of growth and defensive assets, you can develop a second income stream for your discretionary extras – things such as holidays overseas, dining out, upgrading your car and household renovations.

While this sort of income stream can add a lot to your quality of life, particularly in the earlier years of retirement when you can expect to be more active, you won’t be relying on these market-linked investments to make ends meet.

With a well-planned retirement income strategy, and the right investment solutions to meet your cash flow needs and lifestyle goals, you can have the peace of mind that you’ll be covered for life.

Have some questions? Want to know how it applies to you? Want a review of your personal situation? Click here to book a Free 15 Minute Discovery Session, give us a call on 1800 577 336, or email us at hello@wealtheon.com.au.

References

1 Spending patterns in retirement. Challenger Retirement Income Research April 2018.