Quarterly Compass: The End To Low Volatility

In the last 3 months a lot has happened. Our June Compass is always an interesting one because we get an opportunity to review the last financial year as a whole and the last financial year was a doozy, both good and bad.

Things at here at Wealtheon have been going well and Lauren and I are being kept busy working on investments and we are growing strongly.

Over at Huxter Estate, our harvest was disappointing, a lot of early rain meant we lost a huge amount of potential grapes. We only got 1t of grapes which is only a quarter of what we yielded last year. Whilst disappointing, we are resetting for this next growing season which means, it’s time to prune. Pruning is one of my favourite jobs but it means freezing our toes off in the vineyard from sunrise until 9am each morning and then again on weekends.

That’s all from us personally, I hope you have also had a ripper 3 months. Without further ado, let’s get stuck in.

What’s Happening In The Economy?

This is the big burning question on everyone’s lips. The only thing that I can say with certainty is that volatility is back in town and it is likely to stay. To clarify, in the years after the Global Financial Crisis, developed nations have seen an extended period of some of the lowest fluctuations in economic conditions in the last 120 years. This has meant that business, property and employment conditions have been some of the easiest during that period of time. This was supported by large amounts of government quantitative easing and low interest rates which has ended.

Further to this the reserve bank sees global growth forecasts to remain low for the next two years sighting inflation and monetary policy tightening. I believe that the economic conditions will remain tough over the next 6 – 12 months whilst people find their feet in a higher interest rate environment.

We are seeing a lot of builders going bust and we are seeing a lot more businesses entering into liquidation and administration and whilst we haven’t had the official numbers in yet, I think we the way people are spending and the general sentiment, it certainly feels like we are in recession.

The good news is that I think that we have avoided the worst case scenario and whilst, I empathise deeply with the people doing it tough right now, I think the recovery will be solid.

Australian Outlook:

The ASX has felt little of the pain that most households have been feeling over both the last 3 month and the last 12 months. With the ASX performing at just under 15% for the year which brings most portfolios back to where they were after a weak year previous. Australian companies have used inflation data to increase pricing across the board whilst also reducing their staff and limiting wages growth which has meant really strong earnings and dividends but it is only adding to the household pain that most of middle and lower income Australia is feeling.

The Aus property market is holding out well in really tough conditions which is a testament to the kind of asset but also has some hair raising red flags. Australian property is some of the most expensive in the world and yet through all of these interest rate rises, has only dropped around 3-4% across the country over the last 12 months. This is mainly due to supply problems. Put simply, there is not enough housing and Australians are being forced to pay more in high interest rate conditions just to get a roof over their head.

Overall, as the title of this compass suggests, My call over the next quarter (and also the next year) is to see some solid returns but large fluctuations.

International outlook:

It looks likely that a recession will rock a lot of the developed economies around the world over the next 12 months but it is important to note that recession does not mean that investment opportunities are gone. International markets remain a very attractive space to hold funds. Most global markets have grown by high single or double digits over the last 12 month. One of the standouts is the NASDAQ which has posted a solid 24% in the 12 months prior to writing this.

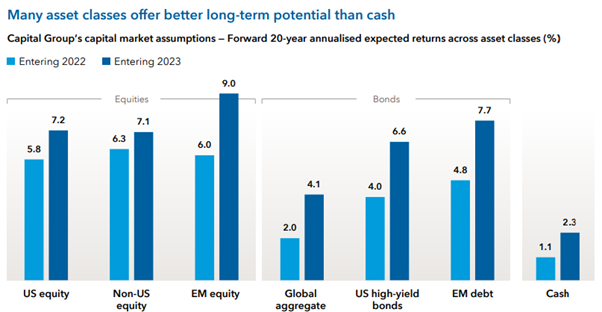

As the graph below shows, expectations on returns across the board are expected to be much greater than cash. It is important to note that during tough economic times, cash can be a safe option but a rush to cash can mean missing out on growth and opportunity.

What does all of this mean for you?

Simply put, we are going to see a lot tougher conditions at a household level in the near future but optimistically, we will likely see so great investment returns and solid results in the near future.

For a lot of our clients portfolios, we have been adding to the core investments over the last year and we are now going to be focussing on bolstering out the satellite investments and taking some concentrated positions in shares and funds to drive some out performance.

Sources

Information on this site may be regarded as general advice. That is, your personal objectives, needs or financial situations were not taken into account when preparing this information. Accordingly, you should consider the appropriateness of any general advice we have given you, having regard to your own objectives, financial situation and needs before acting on it. Where the information relates to a particular financial product, you should obtain and consider the relevant product disclosure statement before making any decision to purchase that financial product.