Summer is over and with the first 3 months of the year down, we start a new quarter. A new quarter is always when we take time to reflect on what’s happened and what we expect to see in the months/year ahead. We have had our Huxter Estate 2023 harvest which was exciting and marked the end to a challenging growing season.

Market Update:

Like our harvest, the last 12 months have been a challenging period for investment and the economy. We have seen not only the continuation of high volatility but also the extension of it.

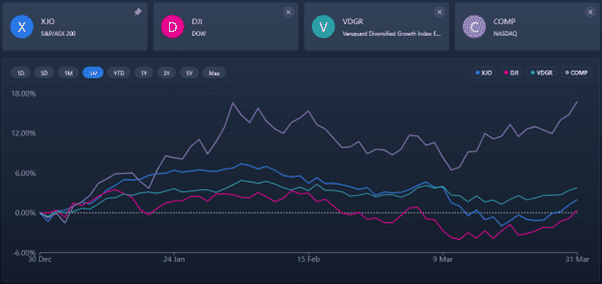

In the first three months we have seen one of the best starts to the year across the globe with investment markets. In Australia the ASX grew by nearly 8% by Feb 2nd and the NASDAQ grew by about 17%.

By mid-March, a lot of those gains were wiped away and the biggest US stock exchange was in negative territory. This is very much on the back of global fears that the continued rising rates were leading to a recession and when SVB collapsed due to a “bank run”, global fears turned to a banking crisis and it seemed that investors were having PTSD flash backs to the Global Financial Crisis (08/09).

The fears of a global financial crisis seemed to be averted and with softer language from federal banks around the world which indicates an easing of rate rises, investment markets have released a sigh of relief.

Australian Outlook:

The outlook for Australia is mixed in my opinion. The Australian economy faces some serious problems but we may be in an excellent position to deal with them comparatively to other countries.

The biggest issues facing Australia right now are:

- Increased cost of living

- Massive increases to debt funding

- Housing shortage

- Skills and labour shortages

- Security fears and sanctions on Russia

When in isolation these issues can be dealt with in a manageable way. The major problem is that all of these chickens (along with quite a few others) and coming home to roost all at once.

The typical process of governments and reserve banks of spending their way out of recession is looking unlikely as we have major skills shortages and government debt has already been run up quite a lot. Couple that with a high cost of goods due to sanctions and supply chain issues and we are one credit crunch away from having a very hard landing.

This means that it is imperative that the reserve bank plays a very fine line between reducing inflation and destroying credit availability.

On the flip side, globally, we are on the brink of a technological revolution with AI leading a lot of advancement. This will be underpinned by raw materials which Australia has a long history of using to its advantage.

International outlook:

The global outlook remains similar to last quarter. The major difference comes down to two things:

- Credit

- Security

Global credit is being challenged through high interest rates and when the US Fed moves the interest rate up, generally smaller economies follow suit in order to have their bonds remain attractive to investment. Banks across the globe generally do not have as much liquidity as Australian banks and regional banks (whilst still massive) need to undertake riskier investments to attract deposit holders.

We saw the spectacular collapse of SVB and then Credit Suisse and it is my belief that we are going to see a lot more of these kinds of collapses over the coming months. This is because in tough times, good companies prosper and poorly managed, overleveraged and/or unprofitable companies fall over. This is as much of a fact in the investment world as the sun setting and rising.

Security is the other factor that is causing pain and it doesn’t look likely to end. China and Russia are actively building the systems to stop using the US dollar as the globes reserve currency.

This is and should be frightening. A major change in the balance of power and currency could have catastrophic and unknown consequences. Whilst frightening, don’t be too alarmed about this.

The global positives are that there are incredible advancements in technology that will change the way we work and interact with each other and all reports about energy advancement seems extremely promising as well.

What does all of this mean for you?

We expect another challenging year in investments as everyone finds their feet. In times like these, there are a lot of opportunities available. The key determining factor in success in 2023 will be cashflow and disposable income that can be used to take advantage of market volatility.

Information on this site may be regarded as general advice. That is, your personal objectives, needs or financial situations were not taken into account when preparing this information. Accordingly, you should consider the appropriateness of any general advice we have given you, having regard to your own objectives, financial situation and needs before acting on it. Where the information relates to a particular financial product, you should obtain and consider the relevant product disclosure statement before making any decision to purchase that financial product.