Welcome to the New Year and the January quarter!

Lauren and I hope you have had an excellent festive break and you are taking full advantage of all of this hot weather.

We have some exciting things that we are working on this year at Wealtheon which I am really excited to be developing. We are creating some new concepts that we will be rolling out in the new financial year so stay tuned for some announcements on that.

Let’s get cracking into the Quarterly update and as always, if you have any questions or need any help, please reach out.

Market Update:

The last three months have been a rollercoaster in investment markets which is indicative of how things were over the last year. I was watching markets dip just before (and over) Christmas and then rally just after the new year. In Australian markets ( which has been one of the most resilient over the last 12 months) We saw drops and increases of more than 5% four times. After suffering the worst year since the GFC, there are a lot of markets that have not faired as well as the ASX or DJIA.

Even a lot of season pros have had the jitters in 2022 as it is being nearly 200 years (the early 1800’s just after the American and French revolutions) Since U.S. stocks and bonds fell by more than 10% at the same time.

We are expecting more of the same roller coaster in 2023 as everyone from individual investors or national economies try to manage the unexpected inflation (and if there is anything that markets hate, it’s uncertainty) but with we think that markets will settle down this year and resume some good growth and strong dividends.

So what do we expect to see?

Australian Outlook:

It feels like a reset of 2022 in Australia which whilst still feeling the after effects of the pandemic has bounced back relatively well. In 2020 and 2021 we were supported by a lot of government spending and low interest rates but all of that has lead to a situation where the chance of a recession is likely.

Australia faces a housing dilemma which is fast becoming a crisis as people struggle to find rentals at homes or funding new builds. this is happening at the same time as the increase in interest rates have brought values screaming back to where they were a few years ago.

As far as advanced economies go Australia should be able to weather the storm relatively well because of our strong commodity exports the opening up of China and improving relations with the second biggest economy in the world as well as the strong labour market.

I think our biggest strength is the fact that our labour market is so tight whilst we have such low unemployment it’s quite difficult to really feel the effects of a recession for the average person.

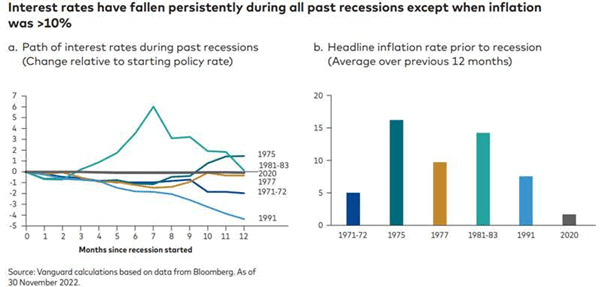

if we look at prior evidence we may expect a rate cut if there is a recession it is my belief that inflation spiking and the run of interest rates to its current levels has been part of a strategic decision to be able to soften a fall if there is a recession by reducing rates again. prior evidence is showing that interest rates have dropped during recessions except where inflation and cost of living has been greater than a 10% annual basis

International Outlook:

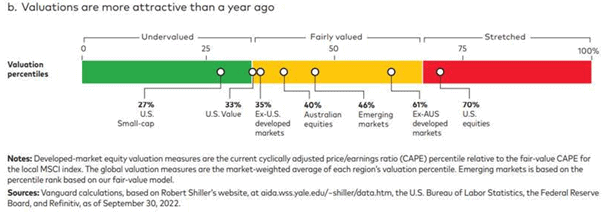

The correction in international markets have led to some better valuations but we still saying quite a lot of meat in the bone within the technology sector in the US market global stocks ah likely going to perform on par with bonds over the next 12 months in most developed nations as many developed international shares are fairly valued or still in some instances overvalued. international small cap investments got hit some of the hardest last year and his my belief that they will be some of the biggest winners over the next few years as they are able to take advantage of a nimble market.

Rates on bonds have grown past dividend you rates which is great for the average retiree investor it does mean that companies will have less opportunities to borrow money and leverage for growth as credit becomes harder to service the value stack on mergers acquisitions and development costs will crunch businesses that don’t have extremely good growth prospects.

What’s going to happen?

I’m expecting people to find the new normal in 2023 and there are some massive advantages that will likely lead to some decent investment returns. bonds for the first time in about four years I looking more attractive as we have to get more money from the yield. we are also in the era of incredible technological advances it is my belief that technology will provide a lot of relief To modern problems in an increasingly globalised world.

I’m personally hoping that a recession will call for some removal of red tape struggling industries like agriculture and construction But I’m not gonna hold my breath waiting for that to happen.

What does all of this mean for you?

all markets rise and fall and this last 12 months has been a great example of that. now moving ever diversified approach to investing and markets in general he’s going to hold the most amount of value over the next five years. this also means that there will likely be some opportunities as we review your situation over the year in order to take advantage of particular stocks and companies that of riding the roller coaster I will provide some incredible discounts that we can take full advantage of.

What should you do about it?

In an inflationary environment like what we have one of the best things you can do is demand high wages and take advantage of the labour market right now. now is also an imperative time to be investing money and not having it sit around in a cash account. the reason for that is that whilst growth prospects may be uncertain with inflation at 7% there is a guaranteed loss on money just sitting in a bank doing nothing.

As always, if you have any questions or would like to discuss any of the above or your portfolio further, please reach out to us on 1800 577 336, or via email at hello@wealtheon.com.au. Speak soon!