Welcome to the quarterly update email for September.

2022 has been a crazy year so far. In the last three months of this year it’s important to reflect on some of the things that have happened and where things are heading. Most the world is still reeling from the effects of a global pandemic which has changed the way that we interact with each other and how we work. There is a war in Ukraine which escalated in February and this has caused massive energy insecurity and inflation largely due to Russian sanctions.

Whilst there is a lot of doom, gloom and uncertainty with things out of our control, it’s important to note that nothing is ever as good or as bad as it seems. Whilst we cannot predict what will happen or stop it from getting worse, we are in full control of the actions we take to prepare for, ride out, and recover from the storm.

It’s very important to remember that whilst the short-term outlook may be bleak, the markets can rally at any time and start to pick up. It could be tomorrow, next week, or a year from now, but if we pull our money out now driven by fear, we may lose much more than if we had stayed the course. Any decision make regarding the investment markets needs to be considered and logical, rather than reactive and born from emotion. Without knowing when the upturn will be (and there always is an upturn!), we cannot make a considered decision to pull out.

With that being said, here’s our breakdown of what is happening in the markets, what it means for you, and what you should be doing about it.

Market Update:

Nearly all global equity markets across the world were sold down in the first half of 2022 as investors and markets have been worried about central banks lifting interest rates to fight what seems to be a crazy amount of inflation. This coincided with the invasion of Ukraine and the Russian military action. As a result, in the first six months the NASDAQ dropped over 30% and the S&P 500 was down over 20%. More emerging markets also took a battering as cost of goods continue to rise globally.

In an attempt to reduce this inflation reserve banks across most of the developed world have lifted rates faster than most people ever expected. This has meant that there’s been no safe haven in the global bond market which normally is a place of security when investment markets are falling.

The concern for markets has been one where the prediction is that high rates would tip and force economies into recession and that there would be limited or negative growth. Many economists have had fears that current market conditions would end up with ‘stagflation’ (no growth with high inflation) and similar results to the economies of the 1970s and 1980s.

The concern for markets has been one where the prediction is that high rates would tip and force economies into recession and that there would be limited or negative growth. Many economists have had fears that current market conditions would end up with ‘stagflation’ (no growth with high inflation) and similar results to the economies of the 1970s and 1980s.

There was a small rebound in June with the prediction that slowing US economy will result in a slowdown in the US Federal Reserves rising rates. With continued high inflation, this hasn’t been the US Federal Reserve’s stance and after the rate rise in September, we’ve seen markets fall back to similar levels that they were at in June.

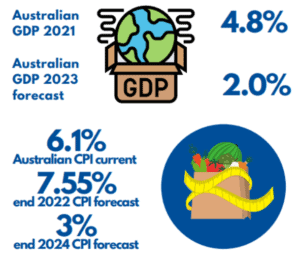

Australian Outlook:

Australian markets saw some resilience in the first half of the year but have since joined global markets, seeing a reduction of around 15%. There doesn’t seem to be a safe haven in Australian markets either, as interest rates have risen and we’ve seen property prices start to drop across nearly all capital cities (down around 5.5% nationally from last year’s highs). With inflation sitting at 6% and cash term deposit rates at around 3%, the buying power of money even sitting in cash is dropping substantially. The Australian stock market is at 6400 points which is similar levels to where it was just before the global financial crisis.

haven in Australian markets either, as interest rates have risen and we’ve seen property prices start to drop across nearly all capital cities (down around 5.5% nationally from last year’s highs). With inflation sitting at 6% and cash term deposit rates at around 3%, the buying power of money even sitting in cash is dropping substantially. The Australian stock market is at 6400 points which is similar levels to where it was just before the global financial crisis.

With the weakening Australian dollar against the US, we may be in for some more inflationary pressures on imported goods which can mean some more pain at the shops and the fuel pump.

What’s going to happen?

We don’t have a crystal ball, but we can look to history to give us some guidance and what may come in the short term. We’re likely going to see a continued rising of interest rates to bring inflation under control which may cause a recession, however unemployment remains very low which is inconsistent with a recession.

What does all of this mean for you?

In simple terms what all of this means is that the cost of living is going up, how much you’re going to have to pay back to the bank in the form of your interest rates will continue to rise, and this is going to mean that asset prices are going to continue to fall in the short term.

What should you do about it?

In terms of the rising cost of living which includes mortgage rates, now is the right time to reflect where your money is going, what your interest rates are and how much you can save. In times like this your cash flow is extremely important and if you feel as though things are getting too tight, please reach out as there may be a number of things that you can do in order to safeguard your financial position.

In terms of investing, we always expect markets to drop and for times to get tough. What you should do in periods of time like this is to be patient with your investments, hold on to them as best you can and if possible, look for opportunities to take advantage of low asset prices.

Next Steps

In order to share as much information as I can, we have organised an exclusive webinar for you which will run through a deep dive into what’s happening in the markets and what it means for you and your portfolios. I’ll be joined by Vanguard’s Investment Specialist Libby Newman to provide some valuable insight on the current economy and it’s effects. You can register for the webinar here.