Are interest rates going up? In this article you will find out how interest rates work and why they might keep going up or what it would take for them to come back down again.

There is no doubt about it. This raising of interest rates has come at blinding speed which no-one was quite ready for.

Why are they going up?

One reason why the reserve bank is raising rates is to reduce the cost of living (inflation) from continuing to rise at such high levels.

It is crucial to a healthy economy to keep inflation at manageable levels. Which for Australia, is around 3%. Currently inflation is at 7%.

How does raising rates reduce inflation?

As the only tool in the reserve banks arsenal, raising interest rates reduces inflation by two factors:

- Increased rates mean money is harder to borrow. This takes the heat out of the ability for you to use debt to expand your business or pay more for assets.

- Increased rates means disposable income is lower. If your loan just went from costing $20,000 to $50,000 then you just lost that ability to spend or save $30,000. This also reduces the demand in the market for goods and services.

When will rates stop rising?

Rates will get getting higher if inflation stays high. There has been only a small effect on inflation with the recent rate rises. This has forced the RBA to keep raising them. The RBA will likely stop when either:

- They break something. (a lot of people are saying that has already happened in the banking sector recently)

- They see a material effect on inflation. This is trickier because a lot of our inflation is caused by a shortage of goods (like petrol) across the globe.

When will rates come down again?

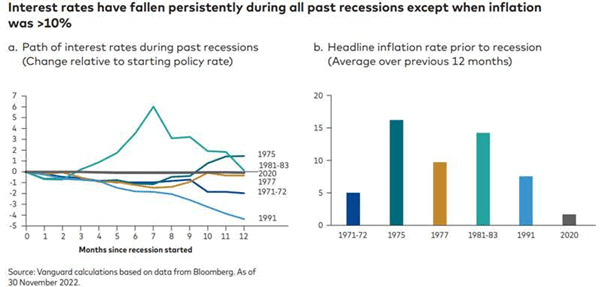

We will probably see rates fall when the economy starts to contract and people stop spending. Look at the graph below. We have seen rates fall every time that there is a recession and inflation is below 10%.

What should you do?

If you are stressed about your interest rate, it is important to know your options.

- You can bury your head in the sand. I don’t recommend this.

- Be proactive with your rate and borrowed amounts. In tough conditions is where there are the most opportunities. Check your rate is competitive. At the time if writing, 5% is a competitive rate. Also, check that your going to be ok if interest rates keep getting higher. Knowledge is power and if you find out that you are over extended then you can do something about it now. If not, then you can rest easy knowing that you are ok.

Let me know if I can help.

I have a few tricks up my sleeve when it comes to debt and assessing if you are over extended or not. If you aren’t sure where to start then reach out by booking a time HERE. We can discuss your situation and what needs to be done to safeguard and then take advantage of current market condition.

If you haven’t already, you can also read our article on the value financial adviser add HERE or download our helpful guide.